Open Banking Regime made easy by award-winning fintech software

Consumer Data Right (CDR) regulations, which are at the heart of a new Open Banking Regime, will come into force in the new year and will be supervised by the Australian Competition and Consumer Commission.

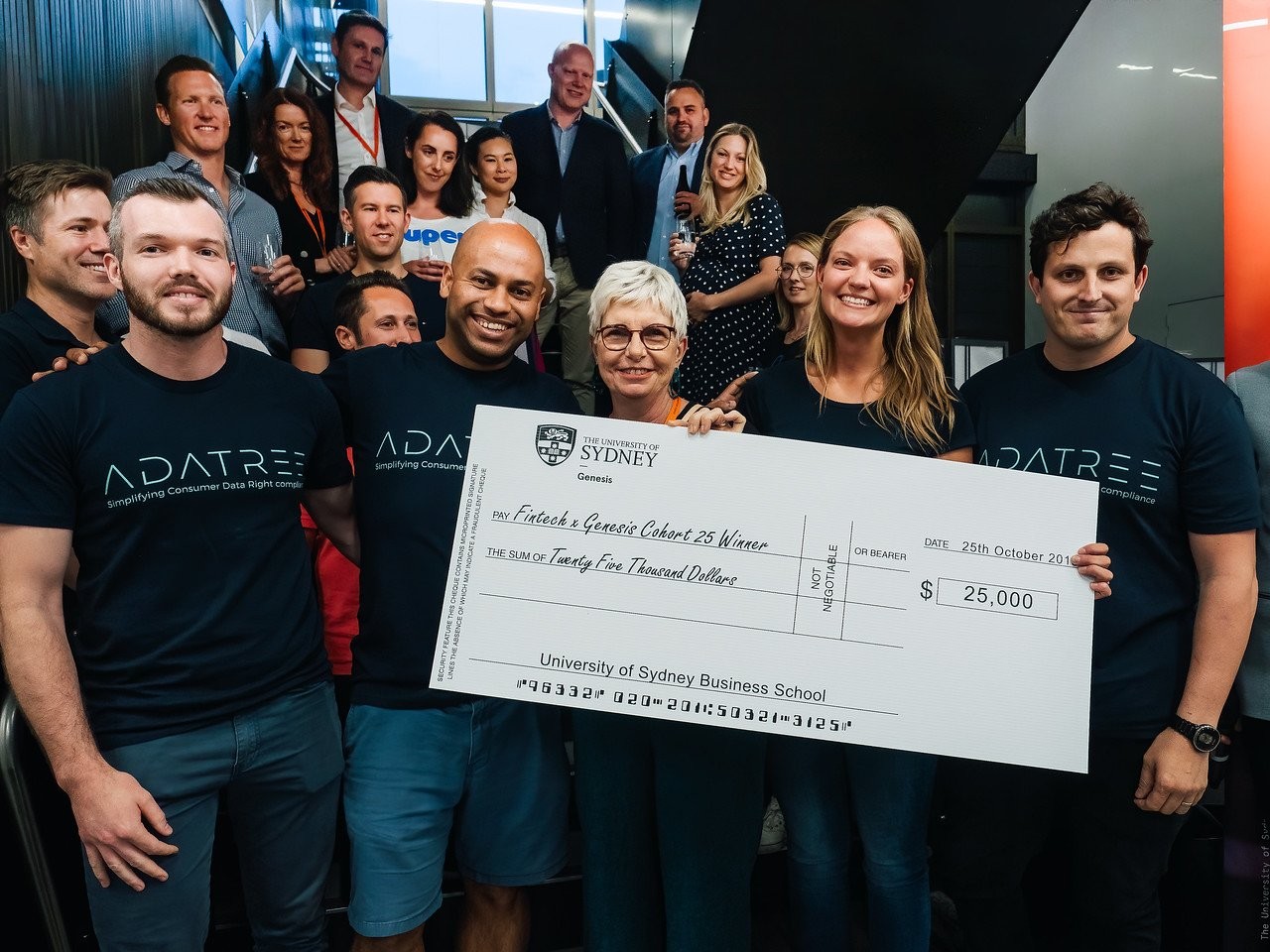

Adatree, which is developing CDR compliance software for banks, fintechs and other technology companies, took out first place and won $25,000 in prize money, in the first fintech competition to be held under the Genesis umbrella.

The competition was held in association with Sydney's 17-day Spark Festival for tech startups.

Jill Berry, a Sydney Business School alumna, says the prize money will fund the further development of Adatree software, which will ease the burden of CDR compliance and "allow organisations to focus on their customers."

Winner of the People's Choice Award in the Genesis fintech competition went to Longevity App, "a smartphone app which boosts users' superannuation through their everyday spending."

"Longevity connects everyday spending accounts, such as debit and credit cards, with existing super accounts. Then whenever you spend through a linked account, we'll automatically take a small amount extra (starting from 1% of spend) and contribute it to your super," explained Longevity's CEO and co-founder, Carla Harris.

"Thanks to the wonders of compound interest, those small but regular contributions can help make up a huge shortfall in the nest egg of many Australians," Ms Harris said.”

The 11-year-old Genesis program is open to University of Sydney staff, students and alumni. Since 2008, it has given nearly 1,500 participants access to masterclasses, mentoring and networking opportunities with established entrepreneurs and industry experts.

Jill Berry, who has already helped build two new digital banks, says she was attracted to Genesis by the mentoring and the opportunity to reconnect with the Business School.

Carla Harris said Longevity joined the program for the networking opportunities and the valuable feedback from experts.

Other finalists in the fintech competition were:

- BarBooks: a simple, intuitive system which provides management, bookkeeping and reporting technology specifically for the legal profession.

- Advisr: provides information on insurance and insurance products and links users with experts and brokers.

- Zuper: a super fund which provides users with a greater degree of control over their investments.

- Kaddy: technology platform which seamlessly manages orders, invoices and payments for industry.

- Finspire: a contemporary financial coaching tool that seeks to personalise the user experience in order to motivate them to change financial behaviours and achieve better outcomes.

The Head of the Discipline of Strategy, Innovation and Entrepreneurship, Professor Leanne Cutcher, described the fintech-specific Genesis as an "outstanding success" and in line with the Business School's focus on digital disruption, particularly in the finance sector.

"The competition again brought together entrepreneurs, investors, inventors, innovators, students and executives," Professor Cutcher said. "It also reaffirmed Sydney Business School's reputation as one of the world's leading centres for fintech development and research."