Tendering zero emissions bus contracts with large mammals in the room

The term ‘ignoring an elephant in the room’ pertains to a situation when there’s a problem of such a significant nature, that it’s easier for one’s sense of immediate well-being to just pretend it isn’t there. After all, when one is ticking along, managing life’s stresses and strains, who wants to acknowledge that there’s a colossal and often feisty mammal in close proximity, one that could at any moment explode and smash everything within reach to pieces? Best look the other way, act like an ostrich and pop on the emperor’s new clothes.

It's ironic that such potent analogies, metaphors, and allegories, have been used within the context of the somewhat cosy and unglamorous field of bus transportation. In 2007, David Ashmore presented a paper which flagged that tendering huge bus area contracts was not likely to achieve the best outcome for the public purse because, when the existing operator owns the buses and the depots, in situations where land values are high, most other operators won’t bother bidding as they are unlikely to be as price competitive as the incumbent (Myers and Ashmore, 2007). To press ahead with tendering under such circumstances would likely lead to the undesirable outcome of a single bid (Ashmore and Mellor, 2010). To ignore this would be discounting the elephant in the room – the asset ownership question. Pragmatic negotiations with asset acquisition over time was the sound call, and the New South Wales government opted for this procurement model.

David Hensher (2021), only this year, began speaking of ‘gorillas in the room’, again in the context of large-scale bus franchising. Elephants and gorillas may well be different animals, but you don’t want to be next to one of them when they become enraged. The gorilla in the room in this instance was once again related to capital assets, but well over a decade had passed and the problem had morphed. Ambitious targets for the introduction of both battery-powered electric and hydrogen fleet were in train, and, now the issue wasn’t just asset ownership, but mass asset conversion. Out with petrol pumps and in with massive volumes of charging equipment. Out with volatile fuel prices and in with huge electricity contracts. Out with diesel mechanics and spanners and in with electric and hydrogen maintenance with all its safety complications. And, perhaps the biggest gorilla of all – out with unlimited range afforded by ‘filling up’ and in, with capped range afforded by battery capacity – what might this mean for the timetable (Ashmore et al, 2021)?

The problem isn’t the technology and migration per se, but the limitations of the current bus franchising and tendering arrangements. It’s ironic that having spent many years to obtain control of strategic assets so as to successfully tender service to the market, the regulators are now facing the conundrum of ‘how does one tender something with such huge cost and risk uncertainty and compare bids?’ On what basis does one ‘buy’? Who wins the competition when the end-game has been articulated, but the middle game is fraught with hurdles, which if not cleared will cost the state literally billions? What happens if someone ‘predatory bids’ – put in a low bid hoping for future risks to be sorted out over time, but they can’t be, and the contract collapses (Alexandersson and Hultén, 2006). Tendering really only works when the specification and risks are cleared. Otherwise, risk has to be shared along the journey. That points to partnerships. But this is theoretically a contestable market? By what right does someone get the right to negotiate and lock other suppliers out? And, surely if one was an operator, the smart move would be to get as much electric and hydrogen equipment into the depots before tender point to make the prospects of value for money tendering almost impossible? Tis a catch 22 – better turn away from both the gorilla and the elephant.

The snag is that operating franchises weren’t built for dramatic change. They are service contracts, where the suppliers are paid to run something to a certain standard, and in turn are paid for service kilometres, labour hours, and annual fleet costs. Very often the assets sit with the state and all the operators do is keep the assets fit for purpose and supply high level services to the public. They take moderate flex – a few kilometres here and there, a few more buses of standard design, but, they aren’t supposed to have a large mammal rampage through them, be that an enormous capital programme, or significant technological change.

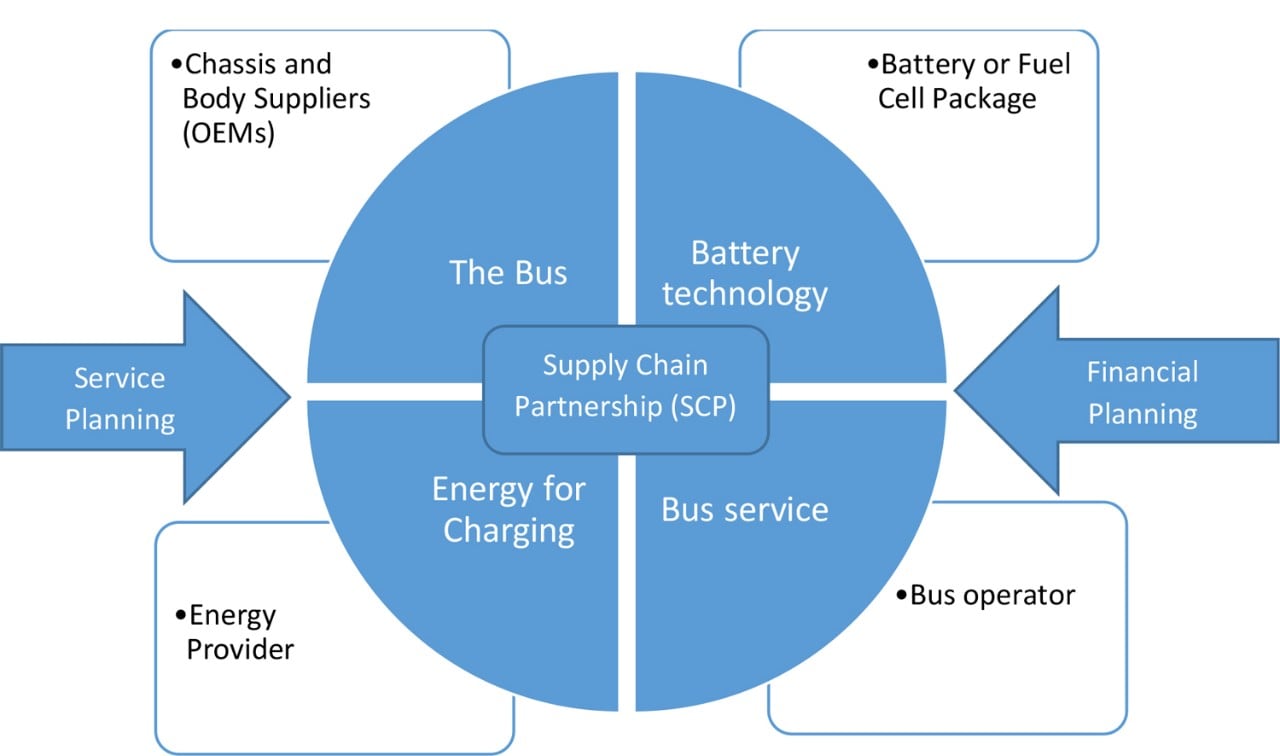

Realistically it’s time to go back to basics and ask what outcome is being sought, not stick rigidly to the current way of buying things. These franchises are now a combination of massive infrastructure procurement and service delivery. The supply chains have shifted, the risk borne across the parties need to accommodate new players. In support of partnership, Collier et al. (20231) state that “Far from being an inferior computer, the human brain has evolved to be well-suited to decisions under uncertainty, and decisions devolved to teams within which people naturally cooperate enable rapid learning through experimentation and copying.” This is the basis of Hensher (2021a) where he argues for an increased role for energy suppliers, bus manufacturers and network infrastructure specialists in particular who stand to benefit significantly, a paradigm shift from traditional contracting i.e., contracts between government and operator, to contracts or management agreements between government and consortiums that account for the entire supply chain i.e., energy, OEM, asset owners, and operators, to give the government certainty of service continuance in a ZEB era, might be more appropriate. It is not unusual for all parties benefiting from an action to be party to the contract. A supply chain procurement model shares the risk and benefits and promotes a competitive process spread over the supply chain (Figure 1).

Figure 1: Supply Chain Partnership Contract Procurement Model (Hensher 2021a)

We’re dealing with something akin to a PPP for a power station and a bus contract (Hensher 2021a). And a lot more. Let’s turn and face the elephant and the gorilla and work with them.

References

Collier, P., Coyle, D., Mayer, C. and Wolf, M. (2021) Capitalism: what has gone wrong, what needs to change, and how it can be fixed, Oxford Review of Economic Policy, 37 (4), 637–649.

Hensher, D.A. and Co-authors (2020) Bus Transport Demand, Economics, Contracting and Policy. 34 chapters drawn from published papers since the last book in 2008 and edited, Elsevier, UK. Order at https://www.elsevier.com/books/bus-transport/hensher/978-0-12-820132-9

Hensher, D.A. (2021) The compelling case for returning to or continuing with negotiated contracts under the transition to a green fleet Transportation Research Part A, 154, 255-269. (see also https://www.ciltinternational.org/education-development/publications-articles/publication/the-compelling-case-for-returning-to-or-continuing-with-negotiated-contracts-under-the-transition-to-a-green-fleet-in-australia/)

Hensher, D.A. (2021a) Is it time for a new bus contract procurement model under a zero emissions bus setting? submitted to Transportation Research Part A, 6 December 2021

Alexandersson, G., Hultén, S. (2006) Predatory bidding in competitive tenders: A Swedish case study. Eur. J. Law Econ. 22, 73–94. https://doi.org/10.1007/s10657-006-8981-7

Ashmore, D., Gregorevitch, M., Lau, A., Moore, C., Serafim, P. (2021) When the bough breaks’: critical questions for the crafting of Australia’s bus franchises in the era of electric fleet. Presented at the Australasian Transport Research Forum, Brisbane.

Ashmore, D.P., Mellor, A.D. (2010) The 2008 New Zealand public transport management act: Rationale, key provisions, and parallels with the United Kingdom. Res. Transp. Econ., 29, 164–182. https://doi.org/10.1016/j.retrec.2010.07.022

Myers, J., Ashmore, D. (2007) When to tender, when to negotiate: why are we ignoring the elephants in the room? Presented at the Thredbo 10 - International Conference Series on Competition and Ownership in Land Passenger Transport, Hamilton Island.