Voluntary betting controls are a bad gamble

A study of 40,000 gamblers in Australia found that a government ‘opt-out’ policy saw a radical shift in online betting behaviour. The study, conducted by the Gambling Treatment & Research Clinic (GTRC) at the University of Sydney, also found that when not required to, the overwhelming majority of online gambling customers did not use voluntary tools designed to limit problem betting.

The research into leading Australian gambling sites found that of the 6,000 people who used deposit limits, a majority stuck to their limit during the course of a year, while one in four changed their limit to make it less restrictive and one in eight decreased or removed the limit all together.

“The marked success of the ‘opt-out’ limit setting policy has important implications; suggesting this strategy could be used to encourage other responsible gambling behaviours,” said co-author Associate Professor Sally Gainsbury.

The findings have been published in the peer-reviewed journal, Psychology of Addictive Behaviors.

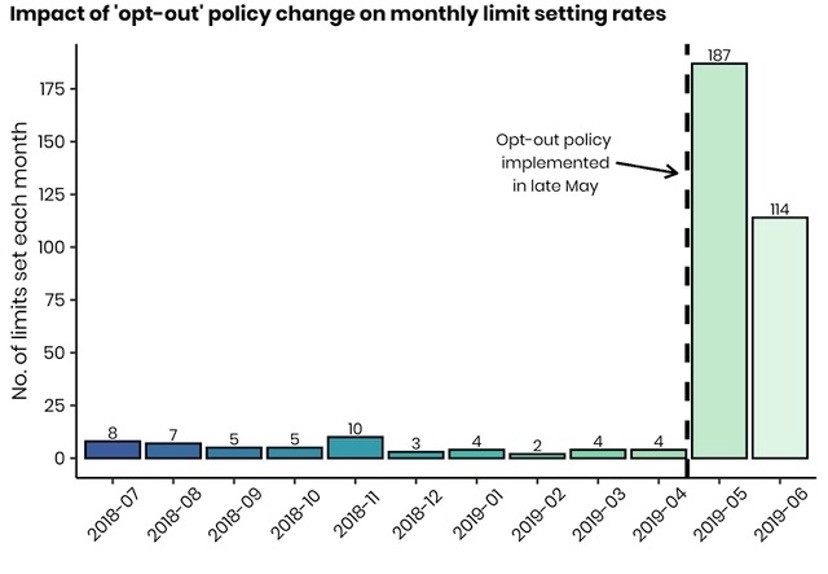

The impact of a policy change on customers setting a limit or opting out of setting one. The bars represent the number of deposit limits set each month by the customers of one gambling site (the others had already introduced a similar opt-out policy before the study period). The sharp increase in uptake in May 2019 corresponds with the introduction of the Australian Government’s opt-out scheme. Credit: University of Sydney.

We noted a spike in the use of deposit limits, which coincided with a new government policy whereby online gamblers had to opt out or set deposit limits. The uptake is in line with trends in organ donations following the change to an opt-out policy...

Lead author, Postdoctoral Research Associate Dr Robert Heirene from the Brain and Mind Centre and School of Psychology, said that during the study, a policy implemented in May 2019 requiring online gambling sites to make customers set a deposit limit or actively opt out of setting one, had major implications for consumer protection.

“We noted a spike in the use of deposit limits, which coincided with a new government policy whereby online gamblers had to opt out or set deposit limits. The uptake is in line with trends in organ donations following the change to an opt-out policy (rather than opt-in), which similarly saw a spike in participation,” Dr Heirene said.

Director of the GTRC, Associate Professor Sally Gainsbury, said the fact that the number of people setting deposit limits per month jumped just after the introduction of the Australian government’s opt-out scheme – from 4 to 187 on one site alone (an increase of almost 5,000 percent) – demonstrated the effectiveness of simple and cheap opt-out strategies.

“This strategy could be trialled for encouraging other responsible gambling behaviours such as limits on spending on other forms of gambling,” Associate Professor Gainsbury said.

“Consideration of gambling control measures like the opt-out scheme are particularly relevant at the moment, given trials under way in Australia for cashless gambling.”

About the study

The GTRC analysed 39,853 customer accounts from six leading sports and race betting sites in Australia over the financial year of 2018-2019.

It found that 83 percent did not use any of the voluntary tools studied – for example deposit limits, ‘timeouts’ and self-exclusion/deactivating the account. Almost all of those who used the tools used only deposit limits. Of those who set deposit limits, half made no changes to their limit after setting it, while 766 people (one in eight) made between one and three changes and 32 people made more than 15 changes.

Interestingly, those who set deposit limits were found to be similar to those who did not gamble, on most characteristics studied such as age, gender, betting frequency, and overall outcome, while those who used timeout/self-exclusions stood out: they were younger, more likely to be male, placed more bets and in bigger amounts, won less, had fewer days without gambling and had more variability in the amount they gambled and the amount they won from day to day.

Dr Heirene explained: “This painted a clear picture: timeout/self-exclusion users appear to gamble in a more problematic way and this insight can focus future research and targeted interventions.”

Future research could examine whether limits on specific sites are the answer, or whether banks should step in to allow people to set limits on gambling across all sites

Associate Professor Gainsbury said the study highlighted a key limiting factor of existing tools: the ability to change and remove self-set limits easily. The two-week lag period between requesting a limit increase or removal that was in place at the time of the study had not proven sufficiently discouraging.

“Future research could examine whether limits on specific sites are the answer, or whether banks should step in to allow people to set limits on gambling across all sites,” Associate Professor Gainsbury said.

“Our study shows much remains to be done to improve online gambling protection and sheds a light on potential pathways for government and industry regarding responsible gambling improvements.”

The authors acknowledge the technical assistance provided by the Sydney Informatics Hub, a core research facility of the University of Sydney.

For gambling help: the GTRC provides a free, confidential service with specialist psychologists, via online and phone sessions. No referral is required but bookings are essential and can be made by calling 1800 482 482 or emailing psychology.gtc@sydney.edu.au